By filling out the federal statistical observation form. Legislative framework of the Russian Federation Report 3 bargaining PM

New form "Information on retail trade turnover of a small enterprise (form 3-TORG PM)" officially approved by the document Order of Rosstat dated September 22, 2017 N 621 (as amended on October 4, 2017, as amended on July 30, 2018).

More information about using the OKUD form 0614009:

- Note to the accountant: reporting for the first quarter of 2009

- Who needs statistical reporting and why?

So the status of small businesses has changed? - The very concept of “small business” has been revised. Many organizations... employees. These are wholesale and retail trade, public catering, services to the population and... turnover; new forms No. PM-torg and No. 3-TORG (PM) have additionally been introduced for these companies. Collecting information... can organizations and entrepreneurs find out about the obligation to provide statistical reporting? - ... 13.19 of the Code of the Russian Federation on Administrative Offenses provides for... it is impossible to obtain much data about the economy of the region and the Russian Federation. ...

- Updated reports on the volume of paid services to the population, on the retail trade turnover of small enterprises

... ;Information on the activities of a collective accommodation facility" (Appendix No. 6); N 3-TORG (PM...) "Information on the retail trade turnover of a small enterprise" (Appendix No. 7). 2 ... N 17 "Form federal statistical observation N 3-TORG (PM) "Information on the retail trade turnover of a small enterprise", approved... ;Form of federal statistical observation Appendix No. 3 to form N P-1 "Information on...

- The volume of services to the population and retail turnover will need to be reported in statistics in a new way.

388 Rosstat approved the following new forms of federal statistical observation: annual (introduced... year): N 1-travel agency "Information on the activities of a travel agency" ... " N 1-AE "Information on administrative offenses in the economic sphere... year: N P (services) "Information on the volume of paid services to the population by...) "Information on the activities of collective accommodation facilities" N 3-TORG (PM) "Information on the retail trade turnover of a small enterprise."

- Rosstat updated 8 forms and returned a number of old ones that were no longer valid in 2015-2014

... "; N PM-prom "Information on the production of products by a small enterprise"; N 1 ... -IP (month) "Information on the production ... - energy sector, as well as form N 3-TORG (PM)" Information on the retail trade turnover of a small enterprise" and a number of other... forms. In this case, the corresponding forms become invalid...

- Version 3.0.75 of the "Taxpayer" configuration has been released

... " (rev. 3.0) for "1C:Enterprise 8". New... in version The configuration includes a new edition of the form... 3/600@ The configuration includes new editions of statistical reporting forms: No. PM-torg " Information on the turnover of wholesale trade of a small enterprise..." (approved by order of Rosstat dated August 27, 2014 No. 536); No. 1-TORG... "Information on the sale of goods by wholesale and retail trade organizations" (approved...

- Version 1.3.61 of the Manufacturing Enterprise Management configuration has been released.

Manufacturing Enterprise Management" (rev. 1.3) for "1C:Enterprise 8" ... November 2014 No. ММВ-7-3/600@). The form is used from reporting for 2014 ... supported in upcoming releases. statistics form No. PM-torg "Information on the trade turnover of a small enterprise" (approved by order of Rosstat... statistics form No. 1-TORG "Information on the sale of goods in wholesale and retail trade organizations... GD-4-3/27262@. Changes in electronic submission of regulated reporting forms For...

3-TORG (PM) - a form of federal statistical observation, which indicates information about the retail trade turnover of an enterprise (Appendix No. 7 to Rosstat Order No. 388 dated August 4, 2016). It is quarterly, filled out with a cumulative total and must be submitted by some organizations to the Rosstat body no later than the 15th day of the month following the reporting period.

That is, 3 TORG PM in 2017 must be passed:

- for January-March - no later than 04/17/2017;

- for January-June - no later than July 17, 2017;

- for January-September - no later than 10/16/2017.

3-TORG (PM): who rents

Form 3 TORG PM must be submitted by legal entities - small businesses (except micro-enterprises), the main activity of which is retail trade, and those included in the sample (clause 1 of the Instructions for filling out the form, approved by Order of Rosstat dated 04.08.2016 N 388 (hereinafter - Instructions), section 2.2 of the Appendix to the Order of Rosstat dated June 24, 2016 N 301). Many territorial branches of Rosstat have posted lists of small enterprises included in the sample survey on their websites on the Internet. This is what Mosgorstat, Novosibirskstat, and Irkutskstat did. By the way, not many lucky ones were included in the sample. For example, in Moscow there were about 230 such companies.

Form 3 TORG PM 2017 must be submitted to the state statistics body at the location of the enterprise. And if the company operates in another place, then - at the place where it actually conducts its activities (clause 2 of the Instructions).

3 TORG PM: instructions for filling

How to fill out 3 TORG PM? Let's start with the title page. It is filled out according to the general rules. Here you must indicate (clause 5 of the Instructions):

- full name of the organization and a short name in brackets next to it;

- address. If the legal address does not coincide with the actual one, then the actual one is indicated;

- OKPO code.

Section 1 shows summary information on retail trade turnover for the reporting period, as well as for the same period of the previous year, which provides a clear comparison of indicators. Retail trade turnover is defined as revenue from the sale of goods to the public for personal consumption, regardless of the method of payment. At the same time, the full cost of goods is included in the turnover, even if they were sold at a discount, on credit, at preferential prices (as in the case of the sale of drugs by pharmacies to certain categories of the population). The cost of goods is taken into account in sales prices, which include trade margins and mandatory payments such as VAT.

The cost of goods sold to legal entities and individual entrepreneurs, as well as the turnover of the public catering sector, are not taken into account in retail trade turnover (clause 6 of the Instructions).

Separately, Section 1 reflects information on the cost of goods sold through online stores, as well as those sold by mail - using catalogs, samples, etc. (clauses 7.8 of the Instructions).

Also, section 1 should contain information about the stocks of goods already purchased and intended for sale to the public. At the same time, in accordance with the procedure for filling out 3 TORG PM, the value of inventories must be assessed based on the average selling prices for similar goods in the reporting period and the corresponding period of the previous year (

3-TORG PM is one of the forms of statistical reporting for small companies in the retail industry. Find out how to fill it out and when to submit it in our article.

3-TORG (PM) in 2017-2018: who submits and where to download the form

The form in question is called “Information on the retail trade turnover of a small enterprise.”

Retailers completing the report should note that:

- frequency of filling out the form - quarterly (cumulative);

- The report must be completed and sent no later than the 15th day of the month following the reporting quarter.

Submission of information in form 3-TORG (PM) is mandatory for a special category of business entities - small enterprises (SE). Medium, large and micro companies do not need to fill out this form.

For information about who is classified as an MP, see the material “Small enterprise - criteria for inclusion in 2017” .

From the general group of small business enterprises, this report is provided by legal entities:

- those engaged in retail trade (sale of goods in small quantities (pieces) through a retail trade network) - a list of such goods is established by TOS (territorial statistical bodies);

- included in the TPS sample (according to the lists posted on their official websites).

If a small enterprise is included in the TPS sample and is at the stage of bankruptcy, it is also required to fill out this form. Such entities are exempt from reporting:

- after completion of bankruptcy proceedings;

- making a record of liquidation in the Unified State Register of Legal Entities.

Read more about the bankruptcy procedure in the article “Liquidation of an LLC with debts to the tax authorities” .

The form of this form, valid for the reporting periods 2016-2017, was approved by Rosstat order No. 388 dated 08/04/2016 (Appendix 7).

You can download it on our website.

For the reporting periods of 2018, the 3-TORG (PM) form should be used in the version updated by Rosstat order No. 621 dated September 22, 2017 (Appendix 4).

It is also available for download on our website.

The structure of the report and the procedure for filling it out

Instructions for filling out the form are given in the same Rosstat orders that approved their forms. There are no fundamental updates in the instructions due to changes in the form.

The report consists of:

- from the organizational (introductory) part, filled in with a standard set of information about the reporting company;

- 3 main sections.

Section 1 “Retail trade turnover”

The section is represented by a table of 4 columns and 5 lines. It provides data as of the reporting date in comparison with the same period last year.

Retail trade volume is reflected in actual sales prices, which include:

- trade margin;

- similar mandatory payments.

Data in the report should not include retail trade turnover:

- in the form of the cost of goods sold at retail to firms and individual entrepreneurs;

- catering turnover

The retail turnover reflected in the report includes those transactions that are confirmed by a cash receipt or a document replacing it.

The section contains data:

- on retail trade turnover with detailed data on food products and methods of sale (via the Internet or by post);

- on the stock of goods for sale to the public at the end of the period.

This article will tell you about the tax nuances of one of the types of retail trade. “Distribution trade on UTII: features of legislation” .

Section 2 “Retail sales and inventories of goods by type”

The second section of the report explains the figures from section 1 on retail turnover and product inventories. Explanations are given in lines 06-82 at the cost of certain types of food and non-food products sold to the population and in stock at the end of the reporting period (meat, fish, dairy products, fresh fruit, vacuum cleaners, refrigerators, televisions, shoes, building materials, medicines, etc. ).

Each product group in the report is listed under the corresponding code from the classifier of products by type of economic activity (OKPD2).

Section 3 “Number of gas stations”

Lines 83-85 of the third section of the report are filled out once a year - only in reporting for the 1st quarter. It includes information on the number of gas stations with details by type of gas station:

- multi-fuel (MTZS);

- gas filling stations (CryoGZS, CNG filling stations, AGZS).

Read about the nuances of using modern cash registers for the retail sale of gasoline in the material “Online cash registers for gas stations since 2017 - clarifications” .

Sample report on retail turnover

Let's look at an example of how to fill out form 3-TORG (PM).

LLC "Molochnaya Dolina" is a small enterprise engaged in the sale of dairy products to the public. In 2017, through a network of retail stores, Molochnaya Dolina LLC sold milk, fermented baked milk, kefir, sour cream, cottage cheese and cheese in the amount of RUB 12,341,000. Inventories of dairy products as of December 31, 2017 amounted to RUB 4,987,670 in value equivalent.

When registering 3-TORG (PM), a company is required to fill out the introductory part, section 1 and 3 explanatory lines from section 2 (17-21), taking into account the following details:

|

Report line |

Name of product |

Product group details |

|

Dairy |

Data on retail sales and inventories of dairy products |

|

|

Of them: Drinking milk |

Retail and Inventory Data:

|

|

|

Dairy drinks |

Sales value and inventory data:

|

|

|

Fat cheeses |

Information about retail sales of cheese |

|

|

Canned milk powder, freeze-dried |

Cost of sold powdered and freeze-dried milk and its balance at the end of the quarter |

See below for a sample report filled out using this data.

Results

If a small business company retails certain types of food and non-food products, it must report quarterly on the volume of retail turnover and inventory of goods at the end of the reporting period. Form 3-TORG PM in 2017-2018 is submitted to the territorial statistics body no later than the 15th day of the month following the reporting quarter.

This form has been put into effect since the report for January-March 2018

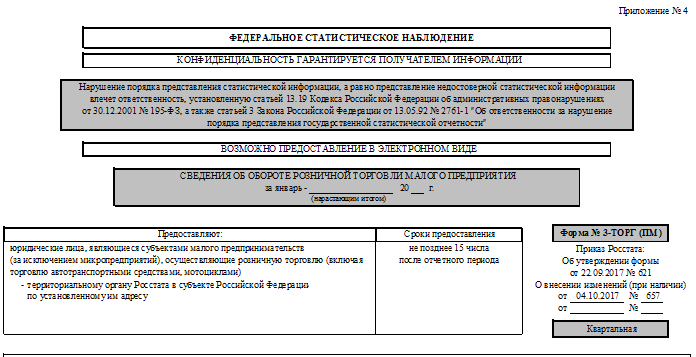

Appendix No. 4

(as amended by Order of Rosstat dated October 4, 2017 N 657)

| FEDERAL STATISTICAL OBSERVATION |

| CONFIDENTIALITY IS GUARANTEED BY THE RECIPIENT OF INFORMATION |

| Violation of the procedure for presenting statistical information, as well as the presentation of unreliable statistical information, entails liability established by Article 13.19 of the Code of the Russian Federation on Administrative Offenses dated December 30, 2001 N 195-FZ, as well as Article 3 of the Law of the Russian Federation dated May 13, 1992 N 2761-1 "On liability for violation of the procedure for submitting state statistical reports" |

| IT IS POSSIBLE TO PROVIDE IN ELECTRONIC FORM |

| INFORMATION ABOUT RETAIL TRADE TURNOVER OF A SMALL ENTERPRISE |

| for January - ______________ 20__ |

| (cumulative total) |

1. Retail trade turnover

(with one decimal place)

2. Retail sales and inventories of goods by type

OKEI code: one thousand rubles - 384

| Name of product groups | N lines | OKPD2 code | Sold to the public | Reserves | ||

| during the reporting period | for the corresponding period of the previous year | at the end of the reporting period | at the end of the corresponding period of the previous year | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Meat and meat products | 06 | 47.22 | ||||

| of them: | ||||||

| animal meat | 07 | 47.22.10.001.AG | ||||

| poultry meat | 08 | 47.22.10.002.AG | ||||

| meat and poultry products | 09 | 47.22.20.000 | ||||

| canned meat and poultry | 10 | 47.22.30.000 | ||||

| Fish, crustaceans and molluscs | 11 | 47.23 | ||||

| of them: | ||||||

Instructions for filling out regional observation form No. 3 “Information on retail trade turnover”

1. Regional observation form No. 3 “Information on retail trade turnover” is submitted by legal entities (commercial organizations, consumer cooperative organizations) that are small businesses (including micro-enterprises), and individual entrepreneurs whose main activity is retail trade (including trade in motor vehicles). vehicles, motorcycles, their components and accessories, motor fuel, except for the repair of motor vehicles, motorcycles, household products and personal items).

The form includes information on the legal entity (individual entrepreneur) as a whole.

The completed form is submitted by a legal entity (individual entrepreneur) to the state government institution of the Samara region “Information and Consulting Agency of the Samara Region” at the address established by it (addresses are listed on the website / ).

3-TORG (PM): Instructions for filling out (sample)

In the event that a legal entity (individual entrepreneur) does not carry out activities at its location, the form is submitted at the place where it actually carries out activities.

Retail trade turnover represents revenue from the sale of goods to the public for personal consumption or use in the household for cash or payments using credit cards, bank checks, through transfers from depositor accounts, on behalf of individuals without opening an account, through payment cards, which is also accounted for as a cash sale.

the cost of goods sold under commission agreements (orders or agency agreements), at the time of sale in the amount of the full cost of the goods, including remuneration;

the cost of goods sent to customers by mail with payment by bank transfer (at the time of delivery of the parcel to the post office);

the full cost of goods sold on credit (at the time the goods were released to customers);

the cost of durable goods sold according to samples (as of the date of issuance of the invoice or delivery to the buyer, regardless of the time of actual payment for the goods by the buyer);

the cost of goods sold through teleshopping and computer networks (electronic commerce, including the Internet), as of the date of issuing an invoice or delivery to the buyer, regardless of the time of actual payment for the goods by the buyer;

the cost of printed publications sold by subscription (at the time of invoice issuance, excluding delivery costs);

Organizations (commission agents, attorneys, agents) carrying out activities in the interests of another person under commission agreements, commissions or agency agreements, the cost of goods sold to the public, fill out the report in full. The principals, trustees, and principals who are the owners of these goods do not provide a report.

Form No. 3 is filled out for each territorially separate division in the context of municipalities (city districts, municipal districts, urban or rural settlements) of the Samara region.

Column 1 lists the names of municipalities (urban districts, municipal districts, rural or urban settlements) where the organization (individual entrepreneur) sells goods to the population; Columns 2, 3 and 4 indicate the cost of goods sold to the population for each municipal entity (urban district, municipal district, rural or urban settlements).

Column 3 highlights data on retail trade turnover in food products, including beverages, and tobacco products.

Column 4 highlights data on retail trade turnover of alcoholic beverages and beer.

For each municipal district, a total is summed up, which is equal to the sum of turnover for the settlements indicated in the form and included in the specific municipal district.

At the end of the table, the total for columns 2-4 is also summed up, which is equal to the sum of the turnover for the city districts and municipal areas indicated in the form.

2. The head of a legal entity (individual entrepreneur) appoints officials authorized to present statistical information on his behalf.

Information is submitted within the time frame and to the addresses indicated on the form.

The address part of the form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets.

The reporting organization (individual entrepreneur) indicates in the code part of the form the code according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code. If the actual address does not coincide with the legal address, then the postal address where the legal entity (individual entrepreneur) is actually located is also indicated.

The report in Form No. 3 is signed by the official responsible for providing information and the head of the organization.

Edit in JSFiddle

/* . . . . . . . . . . .

Error 404

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . */ var body = document.querySelector("body"); body.style.backgroundColor = "#1D1F20"; body.style.whiteSpace = "pre-line"; body.style.paddingLeft = "20px"; body.style.fontSize = "20px"; body.style.color = "#FFFFFF"; // — body.innerHTML = body.innerHTML.replace(/(+) — (http+)/g, "$1"); document.querySelector("content").style.display = "none";Instructions for filling out form 3 bargaining PM > DOWNLOAD_FILE - http://heasouq.filesgeter.ru/?key=%D0%B8%D0%BD%D1%81%D1%82%D1%80%D1%83%D0% BA%D1%86%D0%B8%D1%8F+%D0%BF%D0%BE+%D0%B7%D0%B0%D0%BF%D0%BE%D0%BB%D0%BD%D0%B5% D0%BD%D0%B8%D1%8E+%D1%84%D0%BE%D1%80%D0%BC%D1%8B+3+%D1%82%D0%BE%D1%80%D0%B3+ %D0%BF%D0%BC&mark=jsf Instructions: - Follow the link - Download and run the file Checked, there are no viruses! Instructions for filling out form 3 bargaining PM

Resolution of the National Statistical Committee of the Republic of Belarus. On approval of the state statistical reporting form 1-torg (mp)

Based on the Regulations on the National Statistical Committee of the Republic of Belarus, approved by Decree of the President of the Republic of Belarus dated August 26, 2008 N 445 “On some issues of state statistics bodies”, the National Statistical Committee of the Republic of Belarus DECIDES:

1. Approve the attached form of state statistical reporting 1-torg (mp) "Report on the availability of retail (trade) network facilities and public catering facilities" of annual frequency and put it into effect starting with the report as of January 1, 2010.

2. Approve the attached Instructions for filling out the state statistical reporting form 1-torg (mp) “Report on the availability of retail (trade) network facilities and public catering facilities” and put them into effect starting with the report as of January 1, 2010.

3. Extend the state statistical reporting form specified in paragraph 1 of this resolution to legal entities - microorganizations, individual entrepreneurs engaged in retail trade, public catering in accordance with paragraph 1 of the Instructions for filling out the state statistical reporting form 1-torg (mp) "Availability Report retail (trade) network facilities and public catering facilities" approved by this resolution.

This resolution comes into force fifteen working days after its signing.

Chairman V.I.Zinovsky

APPROVED Resolution of the National Statistical Committee of the Republic of Belarus 10/13/2009 N 216 ————————————————————————- ¦ STATE STATISTICAL REPORTING ¦ ¦———————— ————————————————— ———————————————————————- ¦ CONFIDENTIALITY IS GUARANTEED BY THE RECIPIENT OF INFORMATION ¦ ¦—— ——————————————————————— ————————————————————————- ¦ Representation of distorted data of state statistical reporting, untimely submission or failure to submit such reporting entails the application of administrative or criminal liability measures in the manner established by the legislation of the Republic of Belarus ¦ ¦——————————————— —————————— ————————————————— ¦ REPORT ¦ ¦ on the availability of retail (trade) network facilities ¦ ¦ and public catering facilities ¦ ¦ as of January 1, 20__ ¦ ¦—————————————————— ————————————-+——— —————- ¦ Represent respondents ¦ Deadline ¦ ¦ Form 1-torg (mp) ¦ ¦ ¦submissions¦ ¦ ¦ +————————————+————-+ +————+——-+ ¦ Legal entities - microorganizations,¦ January 4 ¦ ¦Form code ¦0609045¦ ¦individual entrepreneurs, ¦ ¦ ¦according to OKUD ¦ ¦ ¦carrying out retail trade, ¦ ¦ ¦————+——— ¦public catering in accordance with ¦ ¦ ¦ with Instructions for filling out this ¦ ¦ —————- ¦form: ¦ ¦ ¦ Annual ¦ ¦ to the statistics department in the region, ¦ ¦ ¦——————— ¦ city (district of the city of Minsk); ¦ ¦ ¦ to its superior organization ¦ ¦ ¦ (copy at its request) ¦ ¦ ¦————————————+————— —————————————— —————————- ¦Full name of the legal entity, surname, proper name and ¦ ¦patronymic of the individual entrepreneur ________________________________ ¦ ¦______________________________________________________________________________¦ ¦Full name of the separate divisions of the legal entity _____ ¦ ¦__________________________________________________________________________¦ ¦Postal address (actual) ___________________________________________ ¦ ¦_______________________________________________________________________________¦ +———————————+———————+————— ¦Registration number of the respondent¦ Account number ¦ ¦in the statistical register (OKPO) ¦payer (UNP ) ¦ +———————————+————————+ ¦ 1 ¦ 2 ¦ +———————————+———————— + ¦ ¦ ¦ ¦———————————+————————- SECTION I AVAILABILITY OF RETAIL (TRADE) NETWORK FACILITIES ———————-+——+——— ——————————— ¦ ¦ ¦ Operating retail (trade) facilities ¦ ¦ ¦ ¦ as of January 1, 20___ ¦ ¦ ¦ +———————-+——————— -+ ¦ ¦ ¦ ¦ of which are located in ¦ ¦ Types of retail ¦ Number ¦ total ¦ rural populated ¦ ¦ (trade) facilities ¦ lines ¦ ¦ points ¦ ¦ ¦ +————+———-+———— +———-+ ¦ ¦ ¦ ¦ trade ¦ ¦ trade ¦ ¦ ¦ ¦quantity,¦ area, ¦quantity,¦ area, ¦ ¦ ¦ ¦ units ¦square¦ units ¦square¦ ¦ ¦ ¦ meters ¦ ¦ meters ¦ +———————+——+————+———-+————+———-+ ¦ A ¦ B ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ +———— ———+——+————+———-+————+———-+ ¦Stores (sum of lines¦ ¦ ¦ ¦ ¦ ¦ ¦ from 02 to 04) ¦ 01 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦ Including: ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+—— ——+———-+ ¦ food ¦ 02 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦ non-food ¦ 03 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦ mixed ¦ 04 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+— ——-+ ¦Pharmacies ¦ 05 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦Tents, kiosks ¦ 06 ¦ ¦ x ¦ ¦ x ¦ ¦ ¦ +————+———-+————+———-+ ¦Total retail ¦ ¦ ¦ ¦ ¦ ¦ ¦ (retail) objects ¦ ¦ ¦ ¦ ¦ ¦ ¦ (sum of lines 01, 05 and ¦ ¦ ¦ ¦ ¦ ¦ ¦06) ¦ 07 ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦In addition: ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+———-+————+———-+ ¦ gas stations ¦ ¦ ¦ ¦ ¦ ¦ ¦ stations ¦ 08 ¦ ¦ x ¦ ¦ x ¦ ¦ ¦ +————+— ——-+————+———-+ ¦ online stores ¦ 09 ¦ ¦ x ¦ x ¦ x ¦ ¦———————+——+————+———-+ ————+———— SECTION II AVAILABILITY OF PUBLIC FOOD NETWORK (units) ——————————————+——+——————— ¦ ¦ ¦ As of January 1, 20__ G. ¦ ¦ ¦ +————-+———-+ ¦ ¦Number ¦ quantity ¦ ¦ ¦ Types of public catering facilities ¦lines¦ operating ¦ number ¦ ¦ ¦ ¦ facilities ¦landing¦ ¦ ¦ ¦public¦ places ¦ ¦ ¦ ¦ nutrition ¦ ¦ +——————————————+——+————-+———-+ ¦ A ¦ B ¦ 1 ¦ 2 ¦ +—————— ————————+——+————-+———-+ ¦Total (sum of lines from 11 to 19) ¦ 10 ¦ ¦ ¦ ¦ ¦ +————-+——— -+ ¦ Including: ¦ ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ restaurants ¦ 11 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ cafes ¦ 12 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ canteens ¦ 13 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ bars ¦ 14 ¦ ¦ ¦ ¦ ¦ +—— ——-+———-+ ¦ snack bars ¦ 15 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ fast food restaurants ¦ 16 ¦ ¦ ¦ ¦ ¦ +————-+—— —-+ ¦ mini-cafe ¦ 17 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ cafeterias ¦ 18 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦ other objects ¦ 19 ¦ ¦ ¦ ¦ ¦ +————-+———-+ ¦From the total quantity (from line 10) — ¦ ¦ ¦ ¦ ¦objects: ¦ ¦ ¦ ¦ ¦ ¦ +————-+— ——-+ ¦ having seats ¦ 20 ¦ ¦ x ¦ ¦ ¦ +————-+———-+ ¦ located in rural areas ¦ 21 ¦ ¦ ¦ ¦ points ¦ ¦ ¦ ¦ ¦ ¦ +——— —-+———-+ ¦ located in publicly accessible places ¦ 22 ¦ ¦ ¦ ¦——————————————+——+————-+———— Note. The report data is filled in in whole numbers. Head of a legal entity, separate division, individual entrepreneur ___________ _____________________ (underline as necessary) (signature) (initials, surname) Person responsible for compiling state statistical reporting _____________ ___________ _____________________ (position) (signature) (initials, surname) ____________________________ "____" _____________________ 20___ (contact telephone number) (date of compilation of state statistical reporting) APPROVED Resolution of the National Statistical Committee of the Republic of Belarus October 13, 2009 N 216

CHAPTER 1 GENERAL PROVISIONS

PM-torg - instructions for filling out

State statistical reporting in form 1-torg (mp) "Report on the availability of retail (trade) network facilities and public catering facilities" (hereinafter referred to as the report) is submitted by legal entities - micro-organizations engaged in retail trade, public catering through retail stores (pavilions with trading floor), tents, kiosks, pharmacies, gas stations, online stores, catering facilities; individual entrepreneurs engaged in retail trade, public catering through retail stores (pavilions with a sales area), pharmacies, gas stations, online stores, public catering facilities (hereinafter referred to as respondents).

Respondents (except individual entrepreneurs) with retail stores (pavilions with a sales area), tents, kiosks, pharmacies, gas stations, public catering facilities located in small and medium-sized urban settlements (according to the list according to the Decree of the President of the Republic of Belarus dated June 7, 2007 N 265 "On the State Comprehensive Program for the Development of Regions, Small and Medium-Sized Urban Settlements for 2007 - 2010" (National Register of Legal Acts of the Republic of Belarus, 2007, N 144, 1/8650), submit a report on a separate form with a note "small cities" for each small and medium-sized urban settlement.

2. Legal entities submit a report to the state statistics body at their location.

Legal entities whose structure has divisions located in another territory draw up reports on each of them and submit them to the state statistics body at the location of these structural divisions.

An individual entrepreneur submits a report to the state statistics body at the location of a retail store (pavilion with a sales area), pharmacy, gas station, public catering facility.

3. When drawing up the report, technical passports of buildings and other primary accounting documents are used.

4. Data in the report are reflected as of January 1 of the year following the reporting year, in whole numbers.

5. For the purposes of this state statistical observation, terms are used in the meanings defined by the State Standard of the Republic of Belarus STB 1393-2003 “Trade. Terms and Definitions”, approved by the resolution of the Committee on Standardization, Metrology and Certification under the Council of Ministers of the Republic of Belarus dated April 28, 2003. N 22, State Standard of the Republic of Belarus STB 1209-2005 "Public catering. Terms and definitions", approved by Resolution of the Committee on Standardization, Metrology and Certification under the Council of Ministers of the Republic of Belarus dated July 19, 2005 N 33.

6. The report reflects data on the availability of existing retail (trade) network facilities located outside markets and shopping centers. The exceptions are shops, pavilions with a trading floor, pharmacies located on the territory of markets and shopping centers.

Data on the availability of public catering facilities is reflected in the report regardless of their location.

CHAPTER 2 PROCEDURE FOR COMPLETING SECTION I "AVAILABILITY OF RETAIL NETWORK FACILITIES"

7. In Section I, columns 1 and 3 reflect the number of retail trade facilities operating as of the reporting date.

Operating retail (trade) facilities should be considered facilities that actually carry out trade on the reporting date, as well as facilities that are temporarily not operating (less than 6 months) due to repairs, inventory, sanitary treatment and other reasons.

8. On line 01, columns 1 and 3 reflect data on the total number of stores (including eyewear stores), pavilions with a sales floor.

Data about a store that occupies several separate premises in one building, managed by one administration, is reflected in the report as about one store.

If a store occupies several separate premises in different buildings, then each room is counted as an independent object, even if the store located in several premises is managed by the same administration.

9. On lines 2 - 4, columns 2 and 4 reflect data on the sales area of stores (for eyewear stores - data on the area of the sales floor).

The sales area of a consignment store also includes the area for consignors waiting to be received (the consignor's room) and the area of a separate room for accepting items for consignment.

CHAPTER 3 PROCEDURE FOR COMPLETING SECTION II "AVAILABILITY OF PUBLIC FOOD NETWORK"

10. In Section II, Column 1 reflects the number of public catering facilities operating as of the reporting date, including the seasonal network operating as of the reporting date.

A network is considered seasonal if it is open for a specific season of the year.

Operating public catering facilities mean facilities that actually carry out trade on the reporting date, as well as facilities that are temporarily (less than 6 months) not operating due to repairs, inventory, sanitary treatment and other reasons.

11. Line 10 in column 1 reflects the total number of public catering facilities.

Temporarily adapted premises for feeding schoolchildren, indoor bars and buffets (entrance is provided from the hall of a restaurant, cafe), culinary shops, prepared public catering facilities, tents, kiosks are not included in the number of public catering facilities.

Line 22 reflects data on publicly accessible public catering facilities. Public catering facilities include:

public catering facilities in retail trade, cultural organizations (theatres, cinemas, clubs, etc.), sports facilities, consumer service organizations, hotels, campsites, motels, at railway stations (including dining cars, compartment buffets), at river stations , bus stations, air terminals, airports, marinas;

public catering facilities not related to serving a specific population.

Column 2 reflects the actual number of seats and places for standing meals, that is, the number of visitors for whose simultaneous service the catering facility is designed.

The number of places for standing meals is determined at the rate of 0.6 linear meters of table or bar counter length per visitor.

Column 2 does not reflect data on seating in open areas (outdoor cafes, mini-cafes, etc.).

Note. The terminology contained in these Guidelines is used to complete the report only.

Form PM-trading. Information on the trade turnover of a small enterprise (from 07/19/11)

Line 01. Retail trade turnover

Lines 02 - 03. Retail trade turnover of food products, including drinks, and tobacco products

Line 04. Products sold via e-commerce

Line 05. Sold by mail

Line 06. Wholesale trade turnover

Lines 07 - 08. Remains of goods for resale at the end of the month, of which for sale to the public

Line 09. For reference: average number of employees for the previous reporting year

Line 01. Retail trade turnover

Line 01 shows retail trade turnover, which represents revenue from the sale of goods to the public for personal consumption or use in the household in cash or paid by credit cards, bank checks, transfers from depositor accounts, on behalf of individuals without opening accounts through payment cards, which is also counted as a cash sale.

Retail trade turnover also includes:

- the cost of goods sold under commission agreements (orders or agency agreements) at the time of sale in the amount of the full cost of the goods, including remuneration;

- the cost of goods sent to customers by mail, with payment by bank transfer (at the time the parcel is delivered to the post office);

- the full cost of goods sold on credit (at the time the goods are released to customers);

- the cost of durable goods sold according to samples (based on the time of issuing an invoice or delivery to the buyer, regardless of the time of actual payment for the goods by the buyer);

- the cost of goods sold through teleshopping and computer networks (electronic commerce, including the Internet) at the time of issuing an invoice or delivery to the buyer, regardless of the time of actual payment for the goods by the buyer;

- the cost of goods sold through vending machines;

- the full cost of medicines dispensed to certain categories of citizens free of charge or on preferential prescriptions;

- the full cost of goods sold to certain categories of the population at a discount (coal, bottled gas, wood fuel, etc.);

- cost of printed publications sold by subscription (at the time of invoice issuance, excluding delivery costs);

- the cost of packaging that has a selling price that is not included in the price of the product;

- cost of empty containers sold.

Not included in retail trade turnover:

- the cost of goods issued to their employees as payment for labor;

- the cost of real estate;

- cost of goods sold that did not meet the warranty period;

- the cost of travel tickets, coupons for all types of transport, lottery tickets, telephone cards, express payment cards for communication services;

- the cost of goods sold through the retail trade network to legal entities (including social organizations, special consumers, etc.) and individual entrepreneurs.

Organizations (commission agents, attorneys, agents) carrying out activities in the interests of another person under commission agreements, commissions or agency agreements, the cost of goods sold to the public is reflected on line 01 in full. Principals, principals, and principals who are the owners of these goods do not fill out line 01.

Data on retail trade turnover are filled out by both retail trade organizations and wholesale trade organizations if they sell goods to the public.

The turnover of public catering is not included in the turnover of retail trade.

A sign of a transaction classified as retail trade is the presence of a cash receipt (invoice) or other document replacing the receipt. Retail trade turnover is given in actual selling prices, including trade margins, value added tax and similar mandatory payments.

The data on line 01 must be greater than or equal to the data on line 02 in columns 3 - 5.

p.01 >= p.02 according to group 3 - 5

The data on line 01 must be greater than or equal to the data on line 04 in columns 3 - 5.

p.01 >= p.04 according to group 3 - 5

The data on line 01 must be greater than or equal to the data on line 05 in columns 3 - 5.

p.01 >= p.05 according to group 3 - 5

Lines 02 - 03. Retail trade turnover of food products, including drinks, and tobacco products

Line 02 contains data on the turnover of retail trade in food products, including drinks, and tobacco products. Line 03 highlights the turnover of tobacco products.

The data on line 02 must be greater than or equal to the data on line 03 in columns 3 - 5.

p.02 >= p.03 according to group 3 - 5

(Order of Rosstat dated July 19, 2011 N 328)

Line 04. Products sold via e-commerce

Line 04 provides data on the retail turnover of goods sold via e-commerce. E-commerce is the sale of goods based on orders from buyers received online (ON-LINE), where the price and (or) terms of sale are accepted or negotiated over the Internet, e-mail, etc., regardless of the form of payment with the buyer.

(Order of Rosstat dated July 19, 2011 N 328)

Line 05. Sold by mail

Line 05 provides data on the retail turnover of goods sold by mail. The goods are sent to the buyer, who selects them from advertisements, catalogues, samples or other types of advertising.

(Order of Rosstat dated July 19, 2011 N 328)

Line 06. Wholesale trade turnover

Line 06 shows wholesale trade turnover, which represents revenue from the sale of goods previously purchased externally for resale to legal entities and individual entrepreneurs for professional use (processing or further sale).

Commission agents (attorneys, agents) carrying out activities in wholesale trade in the interests of another person (committent, principal, principal) under commission (instruction) agreements or agency agreements, on line 06 reflect only the amount of remuneration received. The cost of goods sold on the basis of commission, commission or agency agreements is reflected by the principals (principals, principals).

Transportation and distribution of gas through gas distribution networks among end consumers (residents, enterprises, etc.), as well as distribution (supply) of electrical and thermal energy on line 06 are not shown, since their sale to the end consumer (i.e. organizations using them in the production of products or for household purposes) is not a wholesale sale.

Sales of goods to the public relate to retail trade turnover and are not reflected on line 06, but are shown on lines 01 - 05.

The cost of lottery tickets, telephone cards, express payment cards, and communication services is not included in wholesale trade turnover. The cost of sold real estate on line 06 is also not reflected.

A mandatory feature of an operation classified as wholesale trade is the presence of an invoice for the shipment of goods.

Data on wholesale trade turnover are filled in by both wholesale trade organizations and retail trade organizations if they resell goods previously purchased externally to legal entities or individual entrepreneurs.

Wholesale trade turnover is shown in actual selling prices, including trade margins, value added tax, excise duty, export duty, customs duties and similar mandatory payments. The amount of remuneration of commission agents (attorneys, agents) is reflected at actual cost, including VAT.

(Order of Rosstat dated July 19, 2011 N 328)

Lines 07 - 08. Remains of goods for resale at the end of the month, of which for sale to the public

Line 07 shows the balances of goods purchased externally and intended for resale.

Legislative framework of the Russian Federation

Line 08 identifies the balances of goods for sale to the public, which must be revalued at the average selling prices for similar goods in effect in the reporting month, including value added tax and similar mandatory payments. Data on the balances of goods intended for sale to legal entities and individual entrepreneurs are reflected at purchase prices. Data on the balance of goods is provided for all storage locations (in warehouses, refrigerated warehouses, warehouses, stores, etc.), including rented ones. Lines 07 and 08 also reflect the balances of goods transferred by the reporting organization for safekeeping. Remains of goods belonging to other organizations and accepted for safekeeping or located in leased areas are not shown on lines 07 and 08.

Organizations (commission agents, attorneys, agents) carrying out trading activities in the interests of another person under commission agreements, commissions or agency agreements do not fill out lines 07 and 08. The balances of goods on lines 07 and 08 are reflected by the owners of these goods - organizations that are principals, principals, and principals.

Lines 01 - 08 are given with one decimal place after the decimal point.

The data on line 07 must be greater than or equal to the data on line 08 in columns 3 - 5.

p.07 >= p.08 according to group 3 - 5

(Order of Rosstat dated July 19, 2011 N 328)

Line 09. For reference: average number of employees for the previous reporting year

The “For reference” section is filled out only by the legal entity as a whole for all its divisions, including branches located on the territory of other constituent entities of the Russian Federation (republics, territories, regions).

Line 09 provides information on the average number of employees of the organization for the previous reporting year, which includes the average number of employees, the average number of external part-time workers and the average number of employees who performed work under civil contracts.

The average number of employees (without external part-time workers) for the reporting year is determined by summing the average number of employees for all months of the reporting year and dividing the resulting amount by 12.

The average number of employees for a month is calculated by summing the number of employees for each calendar day of the month and dividing the resulting amount by the number of calendar days of the month; the number of employees for the previous working day is taken as a weekend or holiday. The list of employees includes employees who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more, both those who actually worked and those who were absent from work for any reason (due to a business trip, illness, annual, additional, study leave, leave without pay, etc.), as well as working owners of organizations who received wages in this organization. When calculating the average number of employees, women who were on maternity leave and additional child care leave are excluded.

Employees hired on a part-time basis are counted in the average headcount in proportion to the time worked.

Simplified method of calculation (conditionally).

In the organization, 5 employees were employed part-time in September: 2 employees worked 4 hours a day, each of them 22 working days. They are counted for each working day as 0.5 people (4.0 hours: 8 hours); 3 workers worked 3.2 hours a day, 22, 10 and 5 working days, respectively. These workers are counted for each working day as 0.4 people (3.2 hours: 8 hours). The average number of part-time workers was 1.7 people. This number is taken into account when determining the average number of employees.

The average number of external part-time workers is calculated in proportion to the time actually worked (see the calculation example above) by summing the average number of external part-time workers for all months of the reporting year and dividing the resulting amount by 12.

The average number of employees who performed work under civil contracts is calculated according to the methodology for determining the average number of employees. These employees are counted for each calendar day as whole units throughout the entire period of this contract, regardless of the period of payment of remuneration. For the reporting year is determined by summing the average number of these employees for all months of the reporting year and dividing the resulting amount by 12.

All small enterprises, except micro ones, must report on key performance indicators.

However, small businesses are required to submit any statistical reporting only if they are included in the sample. If the organization has not received a requirement from the statistical authorities, it is not necessary to submit the PM form.

When to take it

The form is submitted once a quarter.

For the first quarter, you must submit the PM form by April 29, for the first half of the year - by July 29, for 9 months - by October 29, for the year - by January 29.

Download the new PM form for free

Instructions for filling out the PM statistics form

Title page

The title page of the form includes standard data: name, address, organization codes. In this case, you should indicate the full name of the company according to the registration documents, and write a short name in brackets. The address line must reflect the full legal address and the actual address (if it differs from the legal address).

In columns 2 and 3 of the title page, you need to note the OKPO and OKVED codes, respectively. Column 4 should be left blank.

All indicators in sections 1 and 2 are entered on an accrual basis.

First section

If the company uses the simplified tax system, you need to make a note in section 1.

Second section

The second section is filled out based on the number of employees and their salaries.

For each indicator you need to make a mark; to do this, you should circle the corresponding word - “is” or “is not”.

The table includes indicators for average headcount, wage fund and social benefits. Line 03 reflects the average number of employees. Line 03 is equal to the sum of lines 04, 05 and 06.

The accrued wage fund (WF) by employee category is reflected in lines 07-11.