Enterprise management in the conditions of economic crisis. Development of enterprises in a crisis

The global financial crisis, the recession of the global economy, the fall in prices for the main Russian export goods created serious difficulties for the state budget and many domestic enterprises in financing not only development, but also current activities, due to the reduction in business volumes and the number of staff. The crisis makes you think about change, and the application modern methods project management is the best and proven way to implement change quickly, transparently and cost-effectively. The main thing in changes is a firm intention to implement them, understanding and determination to use the approaches proposed modern management projects. At the beginning of 2009, a number of events of SOVNET special interest groups were devoted to this topical topic, on the basis of which this article was prepared.

The crisis is both a source of damage and an opportunity for renewal. It performs such important socio-economic functions, such as revealing hidden conflicts and disproportions, identifying the most powerful owners, restoring the adequacy of socio-economic conditions, updating elites, etc. . From the point of view of project management (PM) practice, a crisis is a shortage of any resource that does not allow continuing and completing a project (stage, project work) on acceptable terms. If all the conditions are met, but the project still “does not go”, then there is a shortage of managerial resources.

The results of 2008 and the first quarter of 2009 do not inspire optimism. However, the crisis began much earlier, its harbingers were talked about so often that they simply stopped paying attention to it. “The current financial crisis is distinguished by both depth and scope - it is perhaps the first time since the Great Depression that it has swept the whole world. The “trigger” that triggered the crisis mechanism was problems in the US mortgage lending market. However, the crisis is based on more fundamental reasons: macroeconomic, microeconomic and institutional. A key role in the development of the current crisis was played by the asymmetry of information1. The structure of derivative financial instruments has become so complex and opaque that it has turned out to be almost impossible to assess the real value of portfolios of financial companies... Credit market. went into paralysis. The development of the situation in the financial sector has also seriously affected the real sector of the economy.

In addition to upset American finances, there are other global problems. Even a simplified picture of their basic relationships is striking in its complexity. The solution of these problems requires joint, and considerable, efforts of many states, because each of them (nuclear weapons, greenhouse effect, acid rains, etc.) can become active at any moment and give rise to such a crisis, in comparison with which the current one may seem like happiness.

There is a heated discussion in the world press about who is to blame for today's economic difficulties. 76% of US residents blame banks for what is happening and financial companies, 58% consider the main culprits of the collapse of obviously insolvent home buyers, etc.

We single out two main aspects of today's crisis.

1. Its generally recognized main beneficiary is the overheated American economy, which needs a decent reason to “deflate financial bubbles”.

2. Officially named culprits are actually invulnerable.

Meanwhile, the excessive dependence of many countries of the world on the American economy makes the United States the main "exporter" of domestic problems.

Often the Russian economy is presented as a victim of the global crisis, but in fact it is not. Long before 2008, many experts warned that the key indicators of the state of the financial, economic and social sphere of the Russian Federation were not only alarming, but had a clear tendency to increase the mismatch of the entire system and reduce its stability. Growing financial difficulties demonstrate Russia's dependence both on the state of affairs in the global economy and on unresolved problems of governance within the country. After a series of international high-level meetings, it became clear that it is extremely difficult to develop a unified solution to combat the crisis, and the reason for this is global geopolitical contradictions, which are very difficult to overcome.

In Russia, by far the most complete and objective open document is the Expert Report, in the development of which the authors of the article took part. An analysis of the existing doctrinal documents of the Russian Federation shows that today there is no scientifically based strategy, methodology for its development and appropriate project management tools for effectively solving the problem of domestic enterprises getting out of the crisis and switching to an innovative development path.

2. SYSTEMIC APPROACH

“Crises are an integral part of living systems. This theoretically understandable reasoning is taken painfully when we are faced with a crisis in practice. Especially when the crisis goes beyond the system that we are able to manage personally. To successfully overcome the crisis, among other things, it is necessary to maintain a certain level of diversity in the system. Changing the conditions of activity in difficult times and after requires new settings, projects, and sometimes lines of activity (types of business) from any business entity. If a system does not have a margin of diversity or readiness for change, it may not survive a crisis. In this regard, the development of such alternative projects as the "Project Russia" is very timely. The systematic approach is widely used in project management, which means that it is necessary to use it to analyze the current financial and economic situation and ways out of it.

The statistics of the use of the word "crisis" in classical documents on PM is interesting. It is never mentioned in the PMI PMBOK® Guide - only issues and conflicts in relation to organizational process assets and project team management. Document

IPMAICB 3.0 this word is very common, but it is used in narrow sense. There is a special competency element "Conflicts and Crises", however, it "covers ways of overcoming conflicts and crises that may arise between individuals and parties involved in a project or program". We are not talking about an external systemic crisis. This situation is surprising, given that there is a very large section of general management dedicated to crisis management and with significant features.

We were convinced that “in the USA and Western Europe, crisis management is being actively introduced into banking as an important and necessary element for the successful functioning of financial institutions. Moreover, crisis management has become an attributive part of the entire spectrum of business, financial and organizational infrastructure of market relations. Companies that manage risks at the required level receive certain benefits from the state and additional discounts for insurance. Crisis management is a comprehensive program that reduces the consequences of risk realization in the worst-case scenario in a deep economic recession.

Unlike risk management, crisis management is a completely independent field of activity, the purpose of which is to reduce the consequences of a crisis, and not to eliminate its causes. In stable years, this worked successfully, but 2008 again showed that the optimization of individual, i.e. American, elements of the world financial and economic system does not mean its optimization as a whole.

For a better understanding of the mechanism of action of various crisis forces, the scientific results of the theory of catastrophes can be used. This theory studies the general laws, principles and approaches to various catastrophic situations and is one of the parts of a more general theory of complex systems. The global systemic crisis has become the main topic today, so the relevant competency requirements, models, and processes should be integrated into PM systems as soon as possible. The authors of this article started this already in the autumn of 2008, using the Eurasian Project Management Standard (ESPM) as the basis of their work as a logical development of the ideas of ICB (IPMA), NTK (SOVNET), a set of PMI standards, past and modern developments of the Russian PM, CIS and leading Asian countries. The section “Peculiarities of project management in times of crisis” of the new edition of the STC SOVNET includes a number of provisions also proposed by the authors.

It is widely believed that the Chinese write the word "crisis" with two hieroglyphs denoting the words "danger" and "opportunity", i.e. for them, in any difficult situation, in addition to problems, there is also potential. Not everyone agrees with this interpretation, but the current state of affairs shows that even in difficult conditions, the Chinese school of state, economic and project management uses the available opportunities effectively and all prospects are open for the PRC.

out of the crisis among the first. “Today, the Chinese economy has become the third largest in the world, surpassing the German one ... At the same time, many experts prefer to compare economies different countries consider GDP at purchasing power parity, which takes into account the difference in prices. On this indicator, China has been in second place for several years, with a significant lead over Japan, which occupies the third position.

The crisis in Russia has its own characteristics, so mindless copying of other people's measures is unacceptable. The global systemic crisis is global, but most of the anti-crisis measures, unfortunately, do not pursue the goal of protection, prosperity and prosperity for everyone at the same time. IMF specialists also speak about the dangers of blind copying. “Emerging economies have been hit harder than developed economies. This is due to the sharp outflow of capital, and the reduction in demand for export products from developed markets, and the fall in prices for raw materials ... They will not be even worse off if they start copying the anti-crisis policy of developed countries. Developing countries must deal with the crisis in their own way, the fund's experts believe. Russian anti-crisis policy is generally similar to what the IMF recommends. But for some reason, the results are far from brilliant: in the first quarter of 2009, GDP collapsed by 9%, industrial production - by 14.3%, and the manufacturing industry collapsed by 20.8%. Unemployment rose by 34.4%. Is this a bad prescription, a misuse of the medicine, or is it just a recovery yet to come?” .

There is no single anti-crisis strategy that is equally beneficial for all countries, just as there are no universal models. crisis management projects. That is why, on the basis of the ESUP, the Eurasian standard for anti-crisis project management was developed as a solution that integrates world experience and the national interests of Russia and other Eurasian countries. This approach does not negate other models and standards, but clearly distinguishes their market segments of application and gravitates towards the IPMA ideology as originally multicultural.

In our practice, we use the following system of definitions.

1.Positioning the crisis (Fig. 2).

■Crisis in the external environment of the project:

Systemic crisis in the external environment of the project;

Local crisis in the external environment of the project.

■Crisis in the internal environment of the project:

Systemic crisis in the internal environment of the project;

Local crisis in the internal environment of the project:

a) a crisis in the subject area of the project;

b) crisis in project management;

c) crisis in other functional areas of the project.

2. The source of the crisis.

■External in relation to the project (imposed from outside).

■Internal in relation to the project (initiated from within).

Rice. 2. Positioning the crisis

3. Relations "subject - object".

■The crisis develops under the influence of factors beyond the control of the project manager.

■ The project manager organizes and manages the crisis for his own benefit.

4.Nature of activity, team, manager.

■Offensive, i.e. active use of the crisis to improve the conditions and opportunities for solving the problems of the project.

■ Defense, i.e. carrying out protective measures to preserve, as far as possible, the conditions and possibilities for solving the problems of the project.

Based on the above systematic approach, we distinguish two areas:

1) anti-crisis project management (combating the consequences of an uncontrollable crisis);

2) crisis management of the project (solution of management tasks by organizing deliberate managed crises).

Anti-crisis project management(AKPM) is a synthesis of anti-crisis management, project management, risk management and management of crisis-affected functional areas (“bringing a ship out of stormy waters into calm ones”). Crisis project management is a standard tool of many stakeholders and project participants, used consciously or unconsciously to cover up the achievement of their goals to the detriment of others (“make the water muddy”, “fish in troubled waters”).

What is essential for any application of these approaches is that a systemic crisis cannot be avoided and cannot be prepared for.

In this difficult time, do not be afraid of losses, main goal the organization (and its projects) should be to increase its own efficiency. Moreover, the systemic crisis cannot be overcome within the framework of a separate project; a way out of it is possible only through the joint efforts of all subjects that form the structures of a new development cycle.

In the field of PM there is also a crisis of management models. The current crisis in Russia is looking more and more like a catastrophe, it has engulfed the real sector of the economy and has become a serious problem for company and project managers. Do they have the ability to deal with the current situation? Yes, because the world models of PM have summarized the best accumulated experience. No, because the crisis that broke out is unprecedented in scale, it already exists, and PM models for overcoming it will not be developed until a few years later. Was it possible to introduce management technologies into these models in a crisis of this magnitude? Apparently, it is impossible, because the following axioms are embedded in the widespread Western standards by default:

■optimization of management for a stable prosperous economy, sophisticated business processes and management competencies;

■ focusing on the interests of the project or corporation;

■Eurocentrism and the superiority of Western management culture.

If you have a sufficient understanding of the integration of your projects into large systems, then you can continue to work as before. If not, then it's time to decide and amend the management system, use more dynamic corporate project management models, which are distinguished by the following features:

■open format, fixation not on the subtle nuances of the methodology, but on goal setting;

■initial localization, organic connection with the mentality, language, business practices;

■proximity to control facilities;

■minimum response time to changing conditions;

■orientation to regional and national needs.

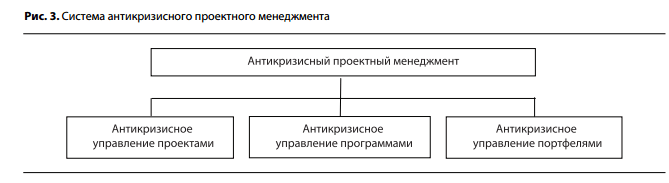

An example of the implementation of this approach is the AKPM system (Fig. 3), developed for the following areas of application of the project, business: liquidation, conservation, preservation; merger, reprofiling, development; reduction of production, personnel; restructuring of the financial portfolio, portfolio of projects; introduction of new technologies, change of strategy.

The goals of ACPM are achieved through the organization of protective and regulatory measures in three areas: external environment, internal environment, management system. A feature of AKPM is a prompt response to changes both outside the enterprise and within it. In such a situation, the need to analyze the prospects of the enterprise as a whole, to develop a strategy for its further development, increases many times over. Only having decided on long-term goals, having developed criteria for evaluating the result, it is possible to help the enterprise in solving problems. The AKPM model is aimed at revealing the hidden potential for the development of the enterprise and helping the leaders of the enterprise at all levels. ACPM is a systematic application of methods and tools for managing various functional areas of projects, portfolios and programs in order to obtain the desired results in a crisis of society, national economy, industry, project.

4. PRACTICE ON ANTI-CRISIS PROJECT MANAGEMENT

What actions need to be taken?

■Enhanced monitoring of the situation in all areas important for business.

■System analysis of the collected information according to a standard scheme or in an anti-crisis mode.

■Analysis of the position of an enterprise or project on the market, clarification of the strategy.

■Scenario planning.

■Harmonization of the project with the external environment during the crisis.

■Maintaining a clear view and sober thinking.

What tools will you need?

■ A structured list of global projects is used to identify the relationship of the project with the environment. This list should include the projects of the company's counterparties, the industry in which it operates,

national economy, interstate structures.

■Set of strategic analysis tools.

4.2. Put things in order in the internal environment

The internal environment of the company and the project is completely in your hands. The level of instability does not have to match the state of the market.

Actions (in this case, they should essentially be similar to the actions taken by the ship’s crew in a difficult situation: “Crew emergency!”, “Clothes for the first term!”, “Remove sails, excess cargo overboard, nose downwind!”:

■ activate the anti-crisis mode of the management system, which provides increased control, reduced response time, unnecessary risks and costs;

■ get rid of unnecessary projects, works, resources;

■strengthen control of the most important parameters;

■ tell the team the truth - this will build trust and support the initiative;

■ Make changes vigorously and systematically.

As tools in this case you can use the following.

■Structured list of enterprise projects. It is completely in your hands.

Update it, analyze the project portfolio, make financially sound decisions on the composition, relationships and order of projects, rational allocation of resources. You must decide whether to continue the project as it is, change it, postpone it, terminate it, outsource it, collaborate with other businesses, or create a new project. The use of AKPM involves turning to tools that are less expensive, simple and quick to use, as well as changing the personnel policy.

■Implementation of core values: adherence to the anti-crisis strategy; effective program and portfolio management; rational goal setting; exploiting the possibilities of competition.

■Designing success after the crisis. The sharper the competition, the more powerful tools it requires, so ACPM - right choice for vigorous action in times of crisis and beyond.

4.3 Set up the control system

Actions. The main thing in this case should be the formation of a management system, and it is necessary to initially build it with a margin of safety, since business in Russia is a constant crisis.

Instruments.

■In managing a company and its projects during a crisis, it is recommended to use a dynamic model that reflects not only the current state of affairs, but also future changes.

■A dynamic enterprise management model is implemented with project portfolio management solutions that allow you to quickly respond to changing conditions and achieve strategic goals with minimal resources.

Do not look for a ready-made anti-crisis system, create it according to your own needs. A crisis - this is a chance for the development of production, innovative technologies, an opportunity to strengthen positions through mergers and acquisitions and the use of sharply depreciated assets and work force.

We offer the following.

■Set yourself up for a long and difficult exit from the crisis.

■Rely only on your own strength.

■Move from process models to competency models.

■Develop anti-crisis models.

■Share projects, reduce costs and risks.

■Develop portfolio management.

■ And most importantly: teach PM "in a real way"!

5. PORTFOLIO MANAGEMENT AND INNOVATION IN A CRISIS

Today, it is imperative to take into account the peculiarities of the crisis, as well as the development of project management, the emergence of new methodologies and the change in the scope of their application. Crisis implies instability, so it is necessary to resist the temptation to use a mechanistic approach and apply a dynamic model of enterprise project portfolio management (Fig. 4), which ensures continuous feedback and monitoring, continuous assessment of the significance of all projects and business lines.

In crisis conditions, the importance of certain areas of project management changes.

In practice, this means that corporate solutions for project and program portfolio management are coming to the fore. It is these solutions that provide real-time analysis of all project activities within the enterprise. At the same time, you are able to see the whole situation as a whole, from the standpoint of various criteria and parameters and the experience of project managers, analysts and experts. The ability to analyze various scenarios for the development of events is especially relevant in difficult conditions. Risk management is of great importance, and it is during a crisis that the harmonization of corporate systems for risk management and project portfolio management systems is necessary. For the last component, three main tasks will be relevant:

1) determination of demand and supply of resources for early detection of their redundancy or insufficiency;

2) optimization of query planning and resource allocation using scenario analysis methods;

3) global distribution of resources according to various criteria, assignments in real time.

Financial management is of particular importance in a crisis. Corporate system Portfolio management (PMS) makes the financial flows of the enterprise transparent for managers. The crisis inevitably leads to the depreciation of assets, so the tasks of managing them in accordance with strategic goals should also be addressed within the framework of the CPMS. Innovations are of particular relevance at this time. Unfortunately, right now, many enterprises find it difficult to find opportunities for innovative development.

With the transition of the Russian Federation to a liberal market model, the Comprehensive Program was curtailed scientific and technological progress and its socio-economic consequences, which existed in the USSR until 1990, along with it, domestic achievements in the field of innovative development were lost. At the same time, the concept of domestic managerial and social innovations was also destroyed, without which all new developments will gradually go to those countries where they will be in demand. Nevertheless, even under such conditions, an effective innovation project management model can yield very positive results.

Today, crises are perceived as a natural property of biological, social, financial and economic systems. Specialists must be able to work, no matter what happens, therefore, in difficult economic conditions, the value of professional project management increases even more. Competently carry out measures directed against the crisis,

to form a portfolio of projects to successfully overcome it and, more importantly, to prepare for innovative development after stabilization of the situation - this is the basis for success.

SOURCES

1. The Chinese economy has reached the third place in the world. - http://www.argumenti.ru/news/news/8062.

2. Glushchenko V.V. Introduction to Crisisology. Financial crisisology. Crisis management. - M.: IP Glushchenko V.V., 2008.

3. State economic policy and economic doctrine of Russia. Toward a smart and moral economy. - M.: Scientific expert, 2008.

4. Eurasian standard for anti-crisis project management, version 1.2, ETsUP, InnIT 2008. - http://www.epmc.ru/docs/ESUP_K_AKPM_090321_01.pdf, http://www.rpm-consult.ru/pdf/ESUP_K_090321_01. pdf.

5. Eurasian project management standard, version 1.2, ECUP 2009. - http://www.epmc.ru/docs/ESUP_K_090321_01.pdf.

6.Eurasian project management standard. Extension for innovation projects, version 1. http://www.rpm-consult.ru/pdf/ESUP_K_Innovation_080922.pdf.

7. Karlinskaya E.V. "Innovative Challenges of Modernity and Russian Doctrine Documents on Innovation in Crisis: Utopia or Reality?" http://www.rpm-consult.ru/pdf/article15.pdf, 2009.

8. Karlinskaya E.V. Application of project methodologies for innovation management in modern world: Report on scientific conference SU-HSE "Modern Management: Problems, Hypotheses, Research". November 20-21, 2008 - http://www.rpm-con-sult.ru/pdf/article22.pdf.

9. Karlinskaya E.V. Standards, methodologies and tools for managing innovation of domestic enterprises in a crisis: Proceedings of the International Conference of the X Anniversary International Forum " High tech 21st century". - M., 2009.

10. Karlinskaya E.V., Katansky V.B. Project management at enterprises in a crisis in Russia: models, methods, applications. - http://www.rpm-consult.ru/pdf/article13.pdf.

11. Kudrin A.L. The global financial crisis and its impact on Russia // Questions of Economics. - 2009. - No. 1.

13.Eurasian way of project management.- http://www.epmc.ru/docs/report_080725.html.

14. Palagin V.S. Project management in the system of high humanitarian technologies. - http://www.zpu-joumal.ru/e-zpu/2008/8Z Palagin/.

15. Palagin V.S. High Humanitarian Technologies of Russian Project Management: Proceedings of the International Conference of the X Anniversary International Forum "High Technologies of the 21st Century". - M., 2009.

16. Palagin V.S. Instrumentalization of the Constitution and doctrines of Russia in national project management. - http://www.epmc.ru/docs/Report%20KDR.pdf.

17. Palagin V.S. Corporate standard for project management in 2009. - http://www.epmc.ru/EPMC_4_Information%20Sources. html#publ.

18. Palagin V.S. World standards of project management and geopolitics // Management of the company. - 2008. - No. 5.

19. Palagin V.S. Strategy for the development of national models of project management for Russia: materials of the IX International scientific conference "Russia: key issues and solutions." - M., 2008.

20. Palagin V.S. Territorial development of Russia and a systematic approach to the application of world standards of project management. - http://www.uniip.ru/index.php?id=6.

21. Palagin V.S., Belyaev M.V. The System of National Interests and National Strategic Design: Proceedings of the IX International Scientific Conference "Russia: Key Problems and Solutions". - M., 2008.

22. Palagin V.S., Karlinskaya E.V. Our response to the Manifesto. - http://www.epmc.ru/EPMC_4_Information%20Sources.html#publ.

23. Palagin V.S., Karlinskaya E.V., Chukhlebov V.V. Financial crisis: time to manage projects. - http://www.epmc.ru/docs/Fincrisis2008.pdf.

24. Kovalev A. Topical issues of banking crisis management // Financial Director. - 2007. - No. 11. - http://www.gaap.ru/biblio/management/strategic/074.asp

25.ICB - IPMA Competence Baseline, Version 3.0. (2006). International project management Association, Van Haren Publishing, Zaltbommel, NL.

26.A Guide to the Project Management Body of Knowledge: PMBOK® Guide. 4th edition. (2008). Project Management Institute, Pennsylvania, USA.

27. With the crisis you! // Expert. - 2009. - No. 1.

Palagin Vladimir Sergeevich - Ph.D. PhD, Associate Professor, CPM, PMP, General Director of the Eurasian Project Management Center (Moscow)

Palagin Vladimir Sergeevich - Ph.D. PhD, Associate Professor, CPM, PMP, General Director of the Eurasian Project Management Center (Moscow)

Karlinskaya Elena Viktorovna - General Director of InnIT LLC (Moscow)

Karlinskaya Elena Viktorovna - General Director of InnIT LLC (Moscow)

Journal PROJECT AND PROGRAM MANAGEMENT ■ 03(19)2009

Relevance of the research topic. Reformation Russian economy in the transition to market relations put forward the task of forming anti-crisis management. The importance of its use is due to the crisis state of production in all sectors of the national economy: about half industrial enterprises in the country are insolvent, do not have working capital to provide production process, and fixed assets are obsolete and worn out by more than 75%. Their reconstruction requires huge capital expenditures and investments. State regulation of market transformations in the context of a deep crisis should take a leading place in the anti-crisis management of commercial firms. Improving the theory and practice of anti-crisis management will lead to a specific strategy, the initiative of business leaders, the introduction of the institution of bankruptcy and the activities of arbitration managers, increased control over the implementation of the law and increased efficiency economic development countries, timely assessment of the crisis state, identification of risks and increase in efficiency entrepreneurial activity.

Reforming the insolvency of enterprises in a competitive environment is a complex process of developing and implementing a set of measures of an economic, legal and technological nature, new management methods, reforming insolvent enterprises, and conducting anti-crisis procedures dictated by the market. This largely depends on the creation of economic and legal conditions, intelligence, knowledge and skills of an anti-crisis manager, the development of non-standard methods and techniques for improving management, financial recovery in emergency economic conditions.

Research objectives:

- to consider the features of enterprise management in a crisis;

- to explore the essence of anti-crisis management and the features of choosing a company strategy in modern conditions;

– consider the mechanism of business planning in the context of anti-crisis management.

The theoretical basis of the study is the work of such authors as Alekseeva M.M., Birman G., Gribalev N.P., Zel A., Zharkovskaya E.P., Tal G.K., Minaeva E.S. and etc.

1.1. The occurrence of crises in the organization

An organization is a relatively separate structural link in the overall economic system. The criteria for such isolation are economic independence, organizational integrity (the existence of an internal and external environment), the presence of specialized information structures, the possibility of highlighting the overall result of work for the organization.

An organization can be considered a separate firm, enterprise, joint-stock company, bank, company (insurance, tourism, etc.), as well as structural units of the public administration system.

The following questions are very important in solving problems of management: in what periods of development of an organization can a crisis arise in it and develop; to what extent the danger of a crisis is determined by the risky change of the organization itself and how this can be connected with the development of the economic environment in which the organization in question operates.

Practice shows that crises reflect their own rhythms of development of each individual organization, sometimes not coinciding with the rhythms community development or development of other organizations. Each organization has its own development potential and the conditions for its implementation, while it is subject to the laws of the cyclical development of the entire socio-economic system. Therefore, the organization is constantly affected by both external factors, determined by the impact of the general cycles of the economy, and internal, depending on their own cycles and crisis development. one

External factors characterize the economic environment in which the organization operates and on which it cannot but depend. If the economy is in a state of systemic crisis, this affects the functioning of an individual organization, and for each in different ways. It all depends on the type of ownership of the organization, the type of its activities and on the economic and professional potential. At the same time, it should be borne in mind that each organization reacts differently to the ratio of internal and external factors affecting its state. Thus, in the event of a systemic crisis, a number of organizations are instantly destroyed, others resist crisis phenomena with all their might, and still others find different possibilities to use the influence of external factors for their own benefit, perhaps temporarily, in the chaos of general crisis phenomena. one

This can be explained by many reasons, among which there is an anti-crisis potential, professional management, increased economic activity, but at the same time one cannot discount the coincidence of circumstances and successful risky decisions.

However, a situation is also possible in which, even with a very favorable external economic situation, the organization enters into a deep crisis. In this case, the reasons, most likely, may be internal factors of development - such as aging technology, inefficient organization of work, miscalculations in economic strategy, mistakes in making economic decisions, business and socio-psychological conflicts, low professionalism of personnel, unsuccessful marketing, and many other. 2

In order to be able to launch anti-crisis management programs in a timely manner, it is necessary to distinguish between the factors, symptoms and causes of a crisis.

Symptoms are manifested in indicators and, which is very important, in the trends in their change, reflecting the functioning and development of the organization. Thus, the analysis of indicators of labor productivity, performance efficiency, capital productivity, energy-to-weight ratio of production, financial condition, or such as staff turnover, discipline, job satisfaction, conflict, etc., can characterize the position of a production organization regarding the onset of a crisis.

In this case, the value and dynamics of indicators can be evaluated both relative to the established recommended value (tolerances for changes), and relative to their values in successive periods of time.

A symptom of crisis development can be, for example, a discrepancy between indicators and regular ratios or a sharp decrease in indicators at certain time intervals. However, the symptoms of the deterioration of the organization do not always lead to its crisis. A symptom is only an external manifestation of the beginning of the "disease" of the organization, but the causes of its occurrence lead to the "disease" itself - the crisis. It is the causes that underlie the onset of symptoms, and then the factors indicating the onset of the crisis.

Thus, the stages of a crisis can be represented by the following chain: causes -> symptoms -> factors.

Crises should be assessed not only by their symptoms, but also by their causes and real factors.

The cause of the crisis is the events or phenomena that cause symptoms and then the factors of the crisis.

Crisis factor - an event or a fixed state of an object, or an established trend, indicating the onset of a crisis.

For example, in an organization, the reasons may be financial and economic miscalculations, the general state of the economy, low qualification of personnel, and shortcomings in the motivation system. The symptoms of a crisis are the appearance of the first signs of negative trends, the stability of these trends, business conflicts, the growth of financial problems, and others, and then the factors of the crisis will be a decrease in product quality, a violation of technological discipline, growth and large debts on loans, etc. 1

From the point of view of the impact on the organization, the causes of the crisis in it can be classified into external and internal. External determine the impact of the environment in which the organization exists, and the occurrence of internal causes depends on the situation in the organization itself. External causes are determined by the state of the economy, the activities of the state, the state of the industry to which the organization in question belongs, as well as the impact of the elements.

The problem of the emergence of crises in the organization should be approached from a systemic perspective. Any organization is an integral system, it consists of interconnected elements, parts, components, etc. At the same time, the development of an organization, even with its quantitative growth, does not change the general characteristics of its integrity, unless, of course, its destruction occurs.

The system in the course of its life activity can be either in a stable or in an unstable state.

Distinguish between static and dynamic stability. Factors affecting the stability of the system can be external and internal. If stability is mainly dictated by external factors, then it is customary to call it external, if internal factors, then internal.

Under the conditions of centralized management of the economy, the stability of production and economic structures was achieved, as a rule, due to the influence of external control decisions, i.e., any or almost any destabilization processes were extinguished from the outside. Moreover, the mechanisms for bringing the system to a stable or quasi-stable state could be very different: these were additional economic support, and the replacement of the director, and the adjustment of plans, and the administrative reorganization of production, etc. In this case, the sustainability of the organization's activities was achieved by management from the outside, and the crisis did not occur. . one

This does not mean that the problem of sustainability did not exist. It simply moved to the industry, regional and state levels and was always decided from above.

All earlier reforms concerned, first of all, higher levels, i.e., state (regional) and sectoral ones. It suffices to cite the facts of the organization of economic councils, the amalgamation (disaggregation) of ministries, the introduction of general management schemes. Currently, in a competitive environment, the problem of organizational stability is faced by every organization.

So, in order to recognize the crisis, it is necessary to detect symptoms in a timely manner, identify factors that indicate the possibility of a crisis, and identify its causes. The means of detecting the possibility of a crisis situation in an organization are intuition and experience, analysis and diagnostics of the state. They should be applied at all stages of the existence of the organization, because a situation is possible in which it can enter into a deep crisis at the peak of its development or in a very favorable external economic environment. one

1.2. Principles of anti-crisis financial management of an organization

From the standpoint of financial management, the possible onset of bankruptcy is a crisis state of the enterprise, in which it is unable to finance its economic activities.

Anti-crisis system financial management based on certain principles, which should be considered in detail.

Constant readiness for a possible violation of the financial balance of the organization. The financial balance of the organization is very changeable in dynamics. Its change at any stage of the economic development of the enterprise is determined by the reaction to changes in the external and internal conditions of its economic activity. A number of these conditions enhance the competitive position and market value of the organization. Others, on the contrary, cause crisis phenomena in its financial development. The objectivity of the manifestation of these conditions in dynamics determines the need for constant readiness of financial managers for a possible violation of the financial balance of the organization at any stage of its economic development.

Early diagnosis of crisis phenomena in financial activities organizations in order to timely use the possibilities of their neutralization.

Differentiation of indicators of crisis phenomena according to the degree of their danger for the financial development of the enterprise. Financial management uses an arsenal of indicators of its crisis development in the process of diagnosing the bankruptcy of an organization. These indicators capture various aspects of the financial activity of the organization, the nature of which is ambiguous from the point of view of generating the threat of bankruptcy. In this regard, in the process of anti-crisis management of the organization, it is necessary, when developing measures to restore the financial balance, to take into account the indicators of crisis phenomena according to the degree of their danger to the financial development of the organization.

The urgency of responding to individual crisis phenomena in the financial development of the organization. Each emerging crisis phenomenon not only tends to expand with each new business cycle of the organization, but also gives rise to new accompanying financial crisis phenomena. Therefore, the sooner anti-crisis mechanisms are activated for each diagnosed crisis phenomenon, the great opportunities the organization will have to restore the disturbed financial balance. Management at this stage can be aimed at the implementation of three fundamental goals that are adequate to the scale of the crisis state of organization 1:

– elimination of insolvency of the organization;

– restoration of the financial stability of the organization (ensuring its financial balance in the short term);

- changing the financial strategy in order to ensure sustainable economic growth of the organization (achieving its financial balance in the long term), self-financing.

The adequacy of the organization's response to the degree of real threat to its financial balance. The system of mechanisms used to neutralize the threat of bankruptcy is overwhelmingly associated with financial costs or losses caused by a reduction in the volume of operational production activities, suspension of the implementation of investment projects, etc. be appropriate for this level. Otherwise, either the expected effect will not be achieved (if the mechanisms are insufficient), or the organization will incur unreasonably high costs (if the mechanism is excessive for a given level of bankruptcy threat).

Full implementation of the internal possibilities of the organization's exit from the financial crisis. In the fight against the threat of bankruptcy, especially in the early stages of its diagnosis, the organization should rely solely on internal financial capabilities. Experience shows that with normal marketing positions of the organization, the threat of bankruptcy can be completely neutralized by the internal mechanisms of anti-crisis financial management and within the financial capabilities of the organization. Only in this case, the organization can avoid painful reorganization procedures for it.

Choice effective forms rehabilitation of the organization. If the scale of the crisis financial condition of the enterprise does not allow to get out of it through the use of internal mechanisms and financial reserves, the organization is forced to resort to external assistance, which usually takes the form of its sanitation. Reorganization of the organization can be carried out both before and during the bankruptcy proceedings.

In the general case, the policy of anti-crisis financial management is to develop a system of methods for preliminary diagnosis of the threat of bankruptcy and the "switching on" of the mechanisms for the financial recovery of the organization, ensuring its exit from the crisis.

1.3. The essence of crisis management and the choice of a company's strategy in modern conditions

The axiom of entrepreneurial activity is that for each project of an enterprise, a serious business plan must be developed, taking into account the prospects for the development of firms and the requirements of the market. It should be in the order of normal market activity with a combination of strategic and tactical elements of financial support for entrepreneurship, management cash flows and finding optimal cost and revenue solutions and securing profits. The essence of anti-crisis management of an enterprise is the ability of management to analyze and regulate the mechanism for planning and distributing profits. The main problematic issue in the crisis situation of the enterprise is financing. one

In the conditions of deepening crisis phenomena, anti-crisis management of an enterprise occupies a leading place in the system state regulation market relations at the federal, regional and local levels.

Overcoming the crisis and increasing the efficiency of production is possible by identifying the real owner of the assets of the enterprise, reforming insolvent enterprises and is a complex process of developing and implementing a set of measures of an economic, legal, organizational and technical nature. The application of New management methods and anti-crisis procedures is mandatory, as it is dictated by modern conditions.

Economic measures are the most effective, as they make it possible to prevent insolvency and bankruptcy with a timely analysis of the state of the enterprise and in the future to see the deepening economic crisis in a successfully operating enterprise. And this is possible thanks to the use of an internal control system, external audit, state financial control over the expenditure of funds, distribution of profits, deviations from business plan indicators, regulatory data, long-term planning and forecasting in the international capital market, goods, raw materials and services.

The crisis phenomenon can be caused by mistakes and unprofessional management. In addition, the crisis is strongly associated with risk. Its exclusion from the management decision will be an unexpected onset of the crisis, will create crisis situations.

Crises occur both in the process of functioning of the enterprise, and in the management of the development of the organization. They threaten viability. The reasons for the development of the crisis can be different: objective, subjective, natural, related to the level of scientific knowledge, imperfection of management, conflict of interests and market needs.

Therefore, depending on the cause of the crisis and anti-crisis management, the consequences of the crisis can lead to drastic changes: to bankruptcy, reorganization, or a soft, long-term and consistent exit of the enterprise to higher indicators. The possibilities of anti-crisis management depend on the goal, the art of managing leaders, the nature, motivation, responsibility, external assistance from state and municipal authorities, sometimes enthusiasm is decisive, although its effect is short-lived. It is impossible to exclude from the program of anti-crisis management national characteristics, cultural traditions, customs, as well as gross mistakes, non-contact of managers, selfish goals and other motivations. one

According to the typology, crises can be partial, systemic, manageable, short-term and protracted, hidden and local, random and regular, artificial and natural. Their consequences can be devastating. From an economic point of view, the classification of risks is also diverse; these are frequent and speculative risks. Frequent risks are divided into natural, environmental, political, transport, property, industrial, trade and commercial.

The inability to manage crisis situations, untimely recognition of the causes and nature of the crisis and their consequences sometimes causes their protracted nature, turning them from latent (hidden) into overt crises.

The characteristics of the criteria for the economic crisis of an enterprise include the real and the upcoming one. The real crisis is considered as determining the assessment of the situation, the choice and development of successful management decisions. But the danger of a crisis always exists, even when it does not exist in reality. It is important to know the signs of the onset of crises and assess the possibilities for their resolution. If overcoming the crisis is a controlled process, then the success of management depends on the timely recognition of the signs of the offensive phases and the stages of objective development. Monitoring of anti-crisis development allows the management system to control processes, track trends according to certain criteria. An important role in anti-crisis management belongs to the state. Differentiating crises by typology, scale, problems, severity, area of development and possible consequences, state management organizations highlight the causes and possible consequences of global signs that can destroy sectors of the national economy. For example, the management of the Aeroflot company decided to replace the fleet with foreign-made aircraft - Boeing and others. The management of the company explained its managerial decision great competitiveness, the best quality characteristics providing soft loans. However, the analysis showed the possibility of a crisis in the development of the country's aviation industry. The prediction of the crisis was revealed on the basis of a special analysis of situations and trends. The decrease in the efficiency of the production of aircraft, orders for them will lead to the decline of powerful factories, will create an acute crisis. The reduction in the production of domestic aircraft leads to a crisis. Therefore, contracts have recently been signed for the supply of large batches of the latest aircraft, and a number of aircraft factories received orders. This was one of the examples of painless resolution of the crisis, its exclusion due to foresight, confident and timely participation of the state in anti-crisis management. Therefore, the interests of the company and the country as a whole clashed here. For the company, its commercial interests are obvious, since it was profitable to purchase aircraft abroad on preferential terms, abandoning domestic equipment, although it is not inferior in quality to foreign ones. The development of the crisis reveals the imperfection of management, lack of knowledge and the level of human development, the use of natural disasters, destruction in political and socio-economic crises.

In 90% of cases, the failures of small commercial firms are associated with the inexperience of managers, the incompetence of managers, their abuse, ineffective management, making erroneous decisions and inability to adapt to market conditions. Even large firms are not immune from such failures. For example, the large company Hermes hired incompetent managers to the staff, which led to the bankruptcy of the company. The main reason for the failure of commercial firms is the crisis situations that are created in the market due to changes in the market conditions, as well as excessive production costs due to the use of outdated equipment, excessive management costs, marriage, irrational use of resources - all this leads to a decrease in competitiveness, the creation of risky venture capital firms that do not have time to respond to changing market requirements. Where no importance is attached to planning and forecasting the timing and volume of income, making payments, the enterprise becomes insolvent. The negative sign is a decrease in the amount Money in company accounts. The sharp increase also points to the inefficiency of investment policy. This often starts with an increase in receivables. Sharply increasing debts of buyers and an increase in the terms of receivables can lead to bankruptcy. Anti-crisis management should take measures to change the policy of commercial credit to its customers, select those who are solvent and expand them, and provide additional income. one

The most positive signs of solvency is an increase in liquidity ratios. Increase in accounts payable, arrears to employees for payments wages, taxes and other payments to the budget - this is a clear sign of the creation of insolvency with an increase in the debt of the resource supplier and creditors. For example, a company has received a loan and is not able to pay it off in a timely manner. At the same time, debt obligations increase even more due to penalties.

The main indicator of the coming crisis may be an increase in overhead costs and a decrease in profits, a decrease in sales. Future crises arise in successful enterprises. Their causes are difficult to predict. They largely depend on the marketing service and the low level of research work: product renewal, the introduction of promising technologies and new cheaper and better raw materials, the company's personnel policy and depend on the occurrence and occurrence of various risks. The classification of risks depends on the conditions and may vary within the goal. Current risks arise as a threat or danger of a loss today, a shortfall in profit due to a shortfall in income. The situation created in retrospect may turn out to be risky for the present reality. When there is a risky situation and the possibility of quantitatively and qualitatively determining the degree of probability of an adverse effect in the form of a flood, fire, earthquake, an erroneous decision of the head of a commercial company.

Always a risky situation statistical processes in the presence of uncertainty, the necessary choice of the optimal solution and the possibility of error, the probability of the chosen solutions or events.

But the probability of the expected result can be obtained on the basis of subjective assessments of the dynamic development of risks. These include financial risks, tax risks, innovation risks, R&D risks, investment risks for lost profits, loss of profits and risks of direct financial loss. Often, investment risks arise during the activities of firms, banks with securities, which are called portfolio risks and are divided depending on operations into diversified and systematic risks.

1.4. Specifics of anti-crisis planning

Anti-crisis planning (ACP) is a direction of planning, which is carried out as one of the functions of anti-crisis management.

Unlike intra-company planning (IFP) carried out within the framework of a “financially healthy” enterprise, the agro-industrial complex takes place in different phases of the enterprise crisis (unprofitability, unprofitability, insolvency) and within the framework of various pre-arbitration (pre-trial resolution) and arbitration procedures (supervision, financial recovery, external management, bankruptcy proceedings). There are other specific differences that need to be highlighted: these are the features of the automatic transmission system and mechanism.

The system of plans has a form (structure) and content. In terms of content, the ACP system, unlike the WFP system, has a typical goal (not a mission) - “financial recovery of the enterprise”, to achieve which it is necessary to solve three typical tasks 1 :

1) elimination of insolvency;

2) restoration of financial stability;

3) settlement with creditors.

These precise guidelines (goal and objectives) determine the specifics of anti-crisis planning:

Clarity, specificity and purposefulness of the content of the entire system of plans.

The coincidence of the strategic and tactical concept (including the timing of implementation).

Focusing on financial, restructuring and marketing activities.

Inclusion of new “steps” or elements in the planning process, such as “Debt restructuring”, “Settlement with creditors”, “Program for the implementation of the Enterprise Financial Recovery Plan” (FOP plan).

Raise specific gravity FOP plan among other plans.

Complication of the interweaving and hierarchy of types of plans: “FOP Plan”, “External Management Plan”, “Business Plans”.

The relationship and subordination of the types of plans to the procedures for reorganization or liquidation of the debtor enterprise (according to the Federal Law "On Insolvency (Bankruptcy)" dated 10/26/2002).

The use of extreme methods for the implementation of plans, and hence the planning of extreme events.

The structural and content features of the ACP system are determined, on the one hand, by internal and external conditions, in which the debtor enterprise is located, on the other hand, the principles on which the anti-crisis planning process is based.

The specifics of the conditions under which the AKP takes place:

Short planning times (approximately one month, except in special circumstances).

Lack of internal, especially financial resources.

The negative impact of external, especially market, factors on the entire ACP process, including the constant deterioration of the state of the enterprise at different stages of the planning process and the implementation of plans. The situation of the enterprise can be compared with a person who has fallen into a swamp, who sinks deeper and deeper every minute, and consequently, all the parameters of his external and internal well-being change.

Hence the need to constantly monitor changes in the internal and external environment, make adjustments to the operational planning and implementation of anti-crisis measures.

The special role of control at all stages of planning: from within - by arbitration managers; outside by creditors.

Unfavorable socio-psychological climate at the enterprise, the possibility of falsifying the initial data and (or) sabotage of planned activities.

Accounting for the features of the crisis phase of the debtor enterprise and its predictive models.

The impact of changes in the Laws and Codes of the Russian Federation on the procedures of the AKU and the AKP (for example, the introduction of a new procedure "Financial recovery" - Chapter V of the new Federal Law "On insolvency (bankruptcy)" dated October 26, 2002, which should be equipped with planning and implementation mechanism ).

The system of anti-crisis plans, as well as the planning process, is based on certain principles, namely:

unity of goals and objectives of planning at all hierarchical levels:

Russian Federation, subjects of the Russian Federation, enterprises;

exact adherence to each letter of the Federal Law "On insolvency (bankruptcy)" dated 10/26/2002 No. 127 F-Z;

systemic, process, situational approach to planning anti-crisis measures and their implementation;

the principle of optimality and economic efficiency;

the principle of priority (ranking goals and objectives according to their importance);

the principle of variance (development of alternatives, their comparison, evaluation and selection of the best option);

the principle of social responsibility (before the team of the enterprise and society).

The specificity of the AKP lies in the extreme nature of the external and internal conditions of the functioning of the debtor organization, which dictate other planning principles that must be taken into account: risk - to the manager in the system of plans, in the process and procedures of anti-crisis planning.

2. BUSINESS PLANNING UNDER THE CONDITIONS OF ANTI-CRISIS MANAGEMENT

2.1. The essence and main provisions of the development of a business plan

Business planning for production and commercial activities not only possible, but also vital for all organizational and legal forms of enterprises. The market does not suppress or deny planning in general, but only moves it mainly to the primary production link - enterprises and their associations. Even in the country as a whole, the area of necessary planning is not completely replaced by the invisible regulating hand of the market. Both in the West and in the East, states determine their economic development strategies, global ecological problems, major social and scientific and technical programs, distribution of the country's budget, defense, etc. At the level of enterprises, not only strategic (long-term) self-planning is carried out, but also detailed development of operational (current) plans for each unit and even workplace. The calendar plans (monthly, ten-day, quarterly, semi-annual) Specify in detail the goals and objectives set by the prospective and medium term plan. Calendar plans production includes information about orders, their availability of material resources, the degree of utilization of production capacities and their use, taking into account the timing of the execution of each order. They also provide for expenses for the reconstruction of existing facilities, replacement of equipment, training of employees, etc. In market conditions, stable enterprises widely use the advantages of planning in competition.

First of all, when substantiating the provisions of the business plan, it is advisable:

focus on issues that may be of interest to those to whom they are addressed - employees of the enterprise, partners or other external consumers;

present the essence of the project in the most accessible form at the very beginning of the business plan;

justify all calculations and indicators in such a way that they are real and reliable, without exaggeration and embellishment of the economic results of the project.

Business plan starts with title page, which is usually indicated by 1:

name of the project, for example, “business plan for creating a wallpaper manufacturing enterprise”;

place of preparation of the plan;

names and addresses of founders;

the purpose of the business plan and its users.

The title page is followed by a table of contents - the wording of the sections of the plan, indicating the pages and highlighting the most important points in accordance with the characteristics of a particular project.

The confidentiality memorandum is drawn up in order to warn all persons about the non-disclosure of the information contained in the plan and its use solely in the interests of the company that submitted the project.

Summary - a summary of the main provisions of the proposed plan, including the following fundamental data: ideas, goals and essence of the project; features of the offered goods (services, works) and their advantages in comparison with similar products of competitors; strategies and tactics for achieving the set goals; qualification of personnel and especially leading managers; forecast of demand, sales of goods (services, works) and the amount of revenue in the coming period (month, quarter, year, etc.); the planned cost of production and the need for financing; expected net profit, level of profitability and payback period; the main success factors are a description of the ways of action and activities.

Description of the industry - analysis of the current state and prospects for the development of the selected business industry, including a description of: its raw material base; segment (niche) of the market and the share of the enterprise on it; potential customers and their opportunities; regional structure of production; fixed assets and their structure; investment conditions.

Analysis of the investment attractiveness of the business sector consists of three stages 1: multivariate analysis of the level of intensity of industry competitiveness; determination of the stage of development of the chosen industry; direct analysis of the investment attractiveness of the industry.

When choosing a business area and industry, information about their position in the global division of labor and on the international market, export opportunities, as well as production and technical ties with other sectors of the economy for which the products of this industry may be of interest (Fig. 1) are useful.

In any country, there are prohibited areas of business (smuggling, pornography, etc.), as well as activities that are the subject of state monopoly (weapons, pesticides, drugs, etc.).

For many entrepreneurs, there are also economic restrictions on penetration into a particular industry: a high level of initial capital; long payback period of invested funds; uncertainty in achieving profit (education, etc.).

It is also necessary to take into account the current conjuncture, since entrepreneurial activity is subject to cyclicality: prosperity, stagnation, decline.

In addition, economic situations differ not only in time, but also in space - by districts and regions. It is more difficult to penetrate into a monopolized industry than into a competitive one. An entrepreneur selects a field of activity from four main types of business (table 1).

Rice. 1. - The main factors in choosing the field of entrepreneurial activity

Table 1

Brief description of the main types of business

|

Business type |

Main functions |

Organizational forms |

|

Industrial |

Production of goods, works, provision of services |

Commercial organizations (enterprises, firms, companies) |

|

Commercial |

Purchase and sale of goods and services |

Trade organizations, commodity exchanges |

|

Financial |

Purchase and sale of currency, securities, investment |

Banks, stock exchanges, financial companies, trust and other organizations |

|

Intermediary |

Provision of services |

Commercial organizations |

|

Insurance |

Insurance and reinsurance |

Insurance companies |

For business success, more than just correct definition a market for oneself, but also finding one's own, often very narrow, area on it, a place that has not yet been occupied or insufficiently used by competitors - a “niche” of the market, i.e. a limited scope of entrepreneurial activity, focused on a specific consumer and allowing a businessman to realize his potential in the most effective way. The search for a “niche” in the market is like a search for free space, a vacuum that needs to be filled as soon as possible. In essence, the “niche” of the market is a combination of urgent and fully conscious needs and problems of society with somewhat not quite conscious, non-traditional forms, ways, methods of solving and satisfying them 1 .

2.2. Features of a business plan in a crisis management

The business plan is drawn up in order to justify and make decisions on restoring the full solvency of the organization, its financial stability and efficient operation in the long term.

The main objectives of the business plan of the organization are 2:

- determination of short-term and long-term goals of the organization;

- development of specific areas of production and economic activities of the organization in accordance with the needs of the market and the possibility of obtaining the necessary financial resources;

– development of a set of procedures to improve production, financial potential ( financial policy), management, supply and marketing systems;

– conducting an inventory of property and determining the composition of free assets for their subsequent sale;

- justification for the application financial assistance;

- justification for changing the production orientation of the organization and the release of new types of products that are more profitable for the organization;

- justification, if necessary, of the reorganization of a legal entity (separation, accession, spin-off, etc.);

- development of a plan of specific measures for the financial recovery of the organization, the timing of their implementation;

– development of an action plan for the restructuring of accounts payable and receivable.

The main sections of the business plan and their content 1:

1. Description of the organization, its characteristics. The results of the analysis of the financial condition of the organization. Causes of financial instability of the organization.

Products and services - types of products, volume, consumer properties, the possibilities of the production and technical base for the production of new products, the availability of qualified personnel.

Management and organization. Organizational and production management structure of the organization, personnel policy. Functions, duties, powers and responsibilities of management personnel. Payment and stimulation, motivation of interests.

Production plan - a description of the range, new developments, characteristics of technology, fixed assets, raw materials, labor resources, mechanization, types and schemes of cooperation, quality control, product service.

5. Marketing is the most important part of a business plan, market research for the supply of material resources and sales of products, competition (the impact of competitors on the market, strong and weak sides competitors, future sources of competition), sales forecast and product consumption forecast, pricing (estimation of own costs, market price analysis, real prices), product distribution methods (types of distribution channels, intermediaries, direct deliveries), sales promotion methods (advertising , personal experience selling, consumer promotion: discounts, gifts), direct marketing, etc.

More detailed descriptions are given of the most important elements of marketing, advertising for example.

Corporate advertising is an advertisement of the enterprise, its successes and merits. The task of branded advertising is to create in society, among potential customers, the preferred image of the enterprise, the image of the enterprise, which would inspire confidence in the enterprise itself and all the goods it produces.

As means of distribution of advertising of the enterprise, the following can be indicated:

– press (newspapers, magazines, books, reference books);

As an example of measures that contribute to the restoration of solvency and support for the effective economic activity of the enterprise, the following can be cited: change of the management of the enterprise; enterprise inventory; restructuring of receivables and payables; reduction of production costs; sale of subsidiaries and shares in the capital of other enterprises; sale of construction in progress; optimization of the number of staff and provision of social benefits for the dismissed; sale of surplus equipment, materials and stockpiled finished products; debt conversion by converting short-term debt into long-term loans; progressive technologies, mechanization, automation of production; improvement of labor organization; overhaul, modernization of fixed assets, replacement of obsolete equipment, acquisition of additional fixed assets.

6. Capital - the structure of own and borrowed capital, assessment of the use of capital, issue of securities (shares, bonds).

7. Risks - internal (by type of activity: production, finance, sales, etc.) and external (economic, market, etc.).

8. Plan (program) of specific measures (measures) for the financial recovery of the organization, increasing its financial stability and competitiveness. Evaluation of their effectiveness from implementation (pessimistic and optimistic estimates).

9. Financial plan - describes the financial results for the past period, provides a forecast of financial results, a schedule of settlements with debtors and repayment of accounts payable (special attention to overdue obligations, the structure of income and expenses, cash flow forecast by quarters, investment activity forecast, assessment of expected results of the organization's activities.

2.3. Functions and principles of business planning

In the most general case, a plan is an image of something, a model of the desired future or a system of measures aimed at achieving the goals and objectives set. A business plan, as one of the most common types of plans at present, is: a working tool for an entrepreneur to organize their work; a detailed program (of rationally organized measures, actions) for the implementation of a business project, which provides for an assessment of costs and income; a document characterizing the main aspects of the activity and development of the enterprise; the result of research and justification of a specific direction of the company's activities in a particular market.

An enterprise can have several business plans at the same time, in which the degree of paperization of justifications can be different. In small business, the business plan and the plan of the enterprise may coincide both in scope and content.

Any business plan should provide convincing answers for the entrepreneur and his potential partners to at least five basic questions (Figure 2).

Rice. 2. The purpose of the business plan and its main elements

Business planning, as a necessary element of management, performs a number of important functions in the business system, among which the following are of the greatest importance:

initiation - activation, stimulation and motivation of planned actions, projects and transactions;

forecasting - foreseeing and justifying the desired state of the company in the process of analyzing and taking into account a combination of factors;

optimization - ensuring the choice of an acceptable and best option for the development of an enterprise in a specific socio-economic environment;

coordination and integration - taking into account the interconnection and interdependence of all structural divisions companies with their focus on a single common result;

management security - providing information about possible risks for the timely adoption of proactive measures to reduce or prevent negative consequences;

streamlining - creating a unified general order for successful work and responsibility;

control - the ability to quickly track the implementation of the plan, identify errors and its possible correction;

upbringing and training - the beneficial effect of models of rationally planned actions on the behavior of employees and the possibility of learning them, including on mistakes;

documentation - the presentation of actions in documentary form, which can be evidence of the successful or erroneous actions of the firm's managers.

When developing business plans, it is necessary to follow the fundamental principles of planning, which create the prerequisites for the successful operation of an enterprise in a particular economic environment.

The basic principles of intra-company planning are as follows.

Necessity: 1) mandatory application of plans in any field of activity is the rational behavior of people; 2) before acting, everyone should know what he wants and can.

Continuity: 1) The planning process at the enterprise should be carried out constantly by: a) the consistent development of new plans at the end of the plans of previous periods; b) rolling planning - after a part of the planning period, an updated plan is drawn up, in which the planning horizon increases, and for the remaining period the plan can be refined due to the appearance of previously unforeseen changes in the external environment or internal capabilities and orientation of the company.

Elasticity and flexibility: adaptation of initial plans to changing conditions is carried out by: a) introducing planned reserves for key indicators; b) application of eventual (in case) planning for different situations data distribution; c) using operational plans to take into account emerging changes in the environment; d) use of alternative plans.

Unity and completeness: consistency is achieved in three main ways: 1) the presence of a common (single) economic purpose and the interaction of all structural divisions of the enterprise on the horizontal and vertical levels of planning; 2) all associated partial plans of the structural units of the company and areas of activity (production, sales, personnel, investment, etc.) should include a general master plan for its socio-economic development in interconnections; 3) inclusion in the plan of all factors that may be important for decision-making.

Accuracy and paperization:

1) any plan must be drawn up with a sufficiently high degree of accuracy to achieve the goal;

2) as we move from operational short-term medium- and long-term strategic plans, the accuracy and paperization of planning, respectively, can decrease until only the main goals and general directions of the company's development are determined.

Cost-effectiveness: 1) the costs of planning should be commensurate with the benefits received from it; 2) the contribution of planning to efficiency is determined by the improvement in the quality of decisions made.

Optimality: 1) at all stages of planning, the choice of the most effective solutions should be ensured; 2) is expressed in maximizing profits and other performance indicators of the company and minimizing cost, with predictable restrictions.

Communication of management levels: 1) is achieved in three ways: a) paperization of plans "top-down"; b) consolidation of plans "bottom-up"; c) partial delegation of authority.

Participation: 1) Active participation of personnel in the planning process enhances their motivation for behavior; 2) Planning for yourself is psychologically and economically more effective than for others.

Holism (combination of coordination and integration): the more structural units and levels of enterprise management, the more expedient (more effective) to plan in them simultaneously and in interdependence. Planning at each structural level of the enterprise independently cannot be effective without the interconnection of plans at all levels.

Ranking of planning objects:

1) investing in the most profitable goods (industries);